4 NH Bills That Could Significantly Impact Short-Term Rental Owners

There are proposed bills moving through the New Hampshire State House that deserve immediate attention from homeowners and short-term rental owners.

Over the next week, lawmakers will hold hearings on FOUR bills that could introduce new taxes, redefine how rentals are classified, and increase costs for small property owners.

Property taxes already increased for most in 2025, and the cost of owning and maintaining a home continues to climb. For most short-term rental owners, hosting is not a windfall. Additional taxes and new classifications could reshape the short-term rental landscape in New Hampshire, impact home values, and make locally owned rentals harder to sustain.

Below is a breakdown of each bill, why it matters, and exactly how you can make your voice heard.

Submitting testimony only takes a few minutes and it sends a clear message that we are paying attention and deserve to be heard.

When we speak up together, our voices carry more weight. Protecting property rights, supporting local ownership, and maintaining a fair tax structure benefits everyone who calls New Hampshire home.

If you would like help navigating the testimony process or understanding how these bills may affect your property, I am always happy to be a resource.

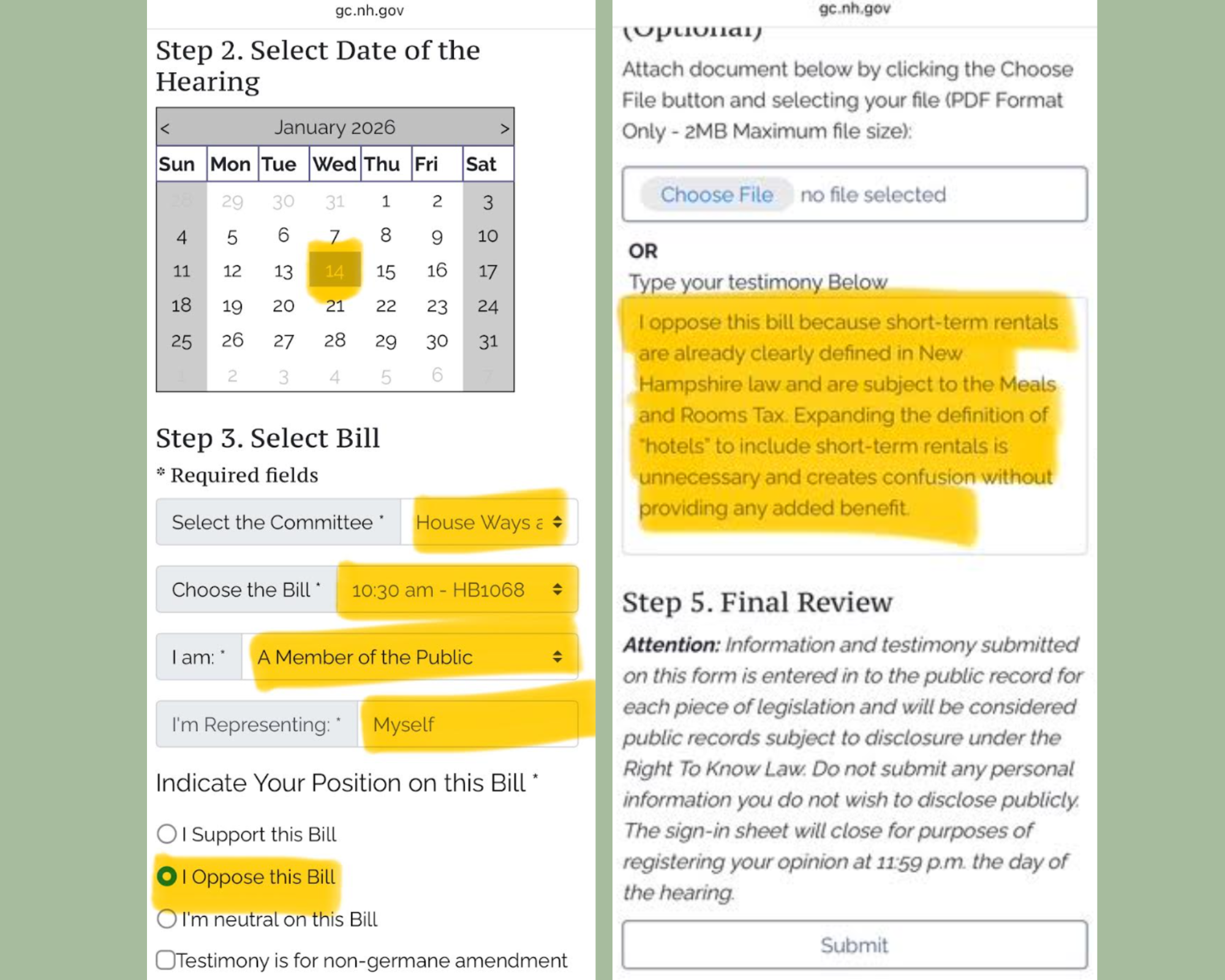

Screenshot of submission process.

Hearing: Monday, January 12 at 11:00 a.m.

HB1580 would impose a new surcharge on nonprimary residences valued over $500,000. This proposal would increase costs for many homeowners and could make hosting financially unsustainable for some.

The bill raises serious concerns about fairness and implementation, particularly for small property owners who already contribute significantly through existing property taxes.

Click HERE to vote and feel free to copy & paste this Testimony or write your own:

I oppose HB1580 because it creates an unjust and unwarranted surcharge based solely on where a property owner resides, unfairly singling out certain homeowners. The bill adds complexity and uncertainty without reliable data. There are already concerns about unclear implementation and increased administrative burdens on municipalities, making this bill more likely to create confusion than any sort of tax relief.

Hearing: Monday, January 12 at 11:00 a.m.

HB1707 would create an additional tax on properties deemed “unoccupied.” In some cases, this could effectively double property taxes by requiring payments to both the municipality and the state.

Short-term rental owners already pay the Meals and Rooms tax. This bill would layer on an additional penalty simply based on how a property is used.

Click HERE to vote and feel free to copy & paste this Testimony or write your own:

This bill creates a new penalty tax based solely on how a property is used. Short-term rental owners already pay the Meals and Rooms tax, yet this bill would add an additional unoccupied housing tax, forcing owners to pay more taxes for lawful use of their own property. This approach undermines property rights, creates confusion and financial hardship for small property owners, and does nothing to meaningfully address housing affordability.

Hearing: Wednesday, January 14 at 10:30 a.m.

HB1068 would redefine short-term rentals as “hotels,” blurring the line between residential and commercial property. This change could open the door to new zoning restrictions, regulatory requirements, and enforcement challenges.

For many homeowners, short-term rentals are occasional and supplemental, not commercial enterprises.

Click HERE to vote and feel free to copy & paste this Testimony or write your own:

This bill dramatically redefines hotels to include properties that were never intended to be treated as commercial lodging. It places new financial and administrative burdens on everyday homeowners who rely on occasional rental income to make ends meet. There is no evidence that this broad expansion is necessary, and it threatens both small property owners and New Hampshire’s tourism economy.

Hearing: Wednesday, January 14 at 9:45 a.m.

SB634 would allow cities and towns to adopt a new local occupancy fee on short-term rentals. This would increase costs and add another layer of complexity for property owners and hosts.

This proposal comes on top of the existing Meals and Rooms tax already paid by short-term rental owners.

Click HERE to vote and feel free to copy & paste this Testimony or write your own:

This bill is unreasonable because it adds a new tax on top of the Meals and Rooms tax already paid by homeowners. Rather than helping communities, this bill penalizes residents, visitors, small businesses, and New Hampshire’s tourism economy as a whole.

Screenshot of voting process.